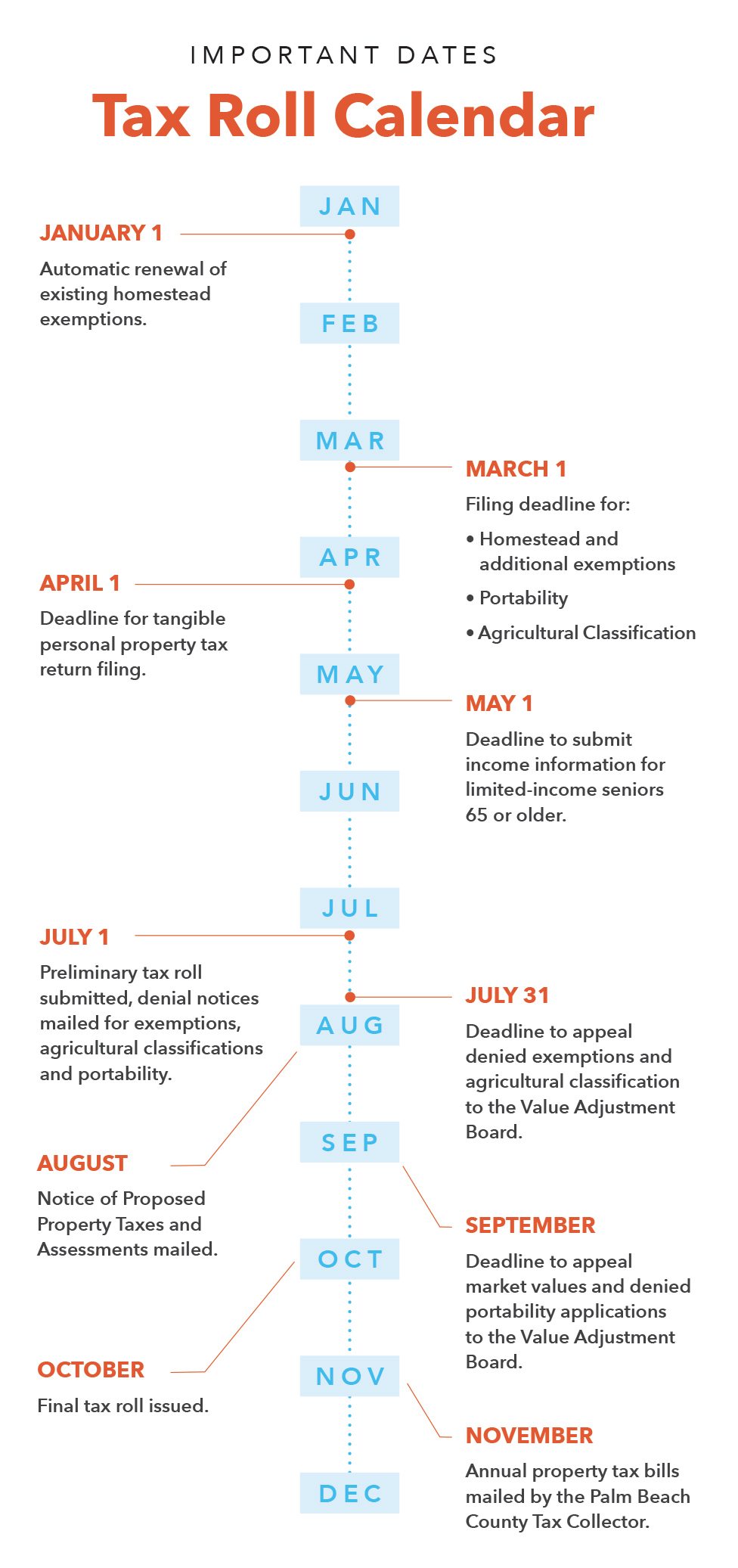

The processes of our office are defined by Florida law which sets an annual calendar for the tax roll cycle.

January 1 – All properties are valued as of this date.

March 1 (or next business day, if on a weekend) – Deadline to file for the current calendar year for:

- Homestead exemption and other exemptions

- Agricultural classification

- Nonprofit/Organizational exemptions

April 1 (or next business day, if on a weekend) – Deadline to file Tangible Personal Property Returns.

May 1 (or next business day, if on a weekend) – Deadline to submit income information for the limited-income senior citizen exemption.

July 1 – The preliminary tax roll is submitted and denial notices are mailed for exemptions, agricultural classifications, and portability.

July 31 or 30 days following the mailing of the denial notices – Deadline to appeal denied exemptions and agricultural classification to the Value Adjustment Board.

Mid-August – Notice of Proposed Taxes and Assessments mailed to all property owners.

Mid-September – Deadline to appeal market values and denied portability applications to the Value Adjustment Board.

November – Annual property tax bills mailed by the Palm Beach County Tax Collector.